Who Qualifies for Rental Insurance? Licensed Rent-a-Car Businesses Only

In Kerala, rental insurance is exclusively available to licensed rent-a-car businesses. These businesses must comply with strict regulations, including obtaining a valid license to operate and ensuring that all vehicles are commercially registered with black number plate with yellow letters, as required under the Motor Vehicles Act. These rules are essential to maintain the integrity and safety of the car rental industry. Rental insurance provides licensed operators with financial protection against potential liabilities, safeguarding their business and offering a reliable, secure service to customers.

Legal or Illegal Rent-a-Car

Renting a car in Kerala comes with specific legal requirements to ensure compliance with the Motor Vehicles Act. Operating a rent-a-car service without a valid license or using privately registered vehicles with white number plates for commercial purposes is strictly illegal. Such practices can result in heavy penalties and legal consequences. Legal rent-a-car businesses, on the other hand, adhere to regulations by using commercially registered vehicles with Black number plates and holding the necessary government approvals. Choosing a legal service not only ensures reliability and safety but also supports the integrity of the car rental industry.

Understanding Standard Car Insurance

Standard car insurance refers to the insurance policy issued for your personal vehicle. It also includes different types of coverages like liability coverage which is mandatory in most places since it pays for injuries and property damage to others if you're at fault. A few others include collision coverage which covers damage to your vehicle from a crash; comprehensive coverage for non-collision events like theft, fire, or vandalism; medical payments or personal injury protection to cover your medical expenses after an accident. Certain personal car insurance policies extend coverage to rental cars, especially when rented for personal use within the same country.

Rental Car Insurance and its Significance

A short-term insurance offered by rental companies to cover potential damages or liabilities while using a rented vehicle is known as rental car insurance. Such insurances include several types of coverages such as:

- Collision Damage Waiver (CDW)/Loss Damage Waiver (LDW) that helps in covering repair costs if the rented car is damaged or stolen.

- Liability Coverage ensures protection to other people’s property or injuries that you may cause while driving

- Personal Accident Insurance is useful for covering medical expenses for you and your passengers

It is absolutely essential to take rental car insurance before renting a car while on a trip. It protects you from unnecessary expenses in case of an accident or theft. In international rentals or regions where your standard policy might not apply, this protection becomes even more critical

Key Differences Between Rental Insurance and Standard Insurance

Rental car insurance is specific for the rental period and vehicle while standard car insurance is for your personal vehicle, which may extend to rentals depending on the company. While rental car insurance is taken for a short term, extending from a few days to a few weeks, standard car insurance is taken for a long term. The former demands a daily fee which varies with the provider whereas the latter is paid in monthly or annual premiums. Rental car insurance is optional and customizable at the rental desk whereas standard car insurance comes with pre-set coverage, any changes require formal updates. Rental car insurance is often limited to domestic rentals or specific regions but standard insurance may include international coverage. Rental agency handles the claim process in case of rental car insurance. You may have to file with your insurer and pay a deductible in case of a standard car insurance.

When Is Rental Car Insurance Necessary?

More often than not, people think that having a standard car insurance is enough when renting a vehicle. But there are certain scenarios where rental car insurance becomes necessary.

- Traveling Abroad: Most standard car insurance policies do not cover international rentals. In such cases, buying rental car insurance is crucial.

- Lack of Comprehensive or Collision Coverage: If your policy doesn't include these, you'll be on the hook for damage to the rental vehicle

- High-Deductible Policies: Even if you have coverage, a high deductible might make rental car insurance worth the extra cost

- Business Travel: Some personal policies exclude coverage for rentals used for business purposes. Confirm with your insurer before relying on your own policy

- Concern Over Rate Increases: Filing a claim with your insurer—even for a rental car—can raise your premiums. Using rental insurance avoids this risk.

Tips for Selecting the Right Rental Car Insurance Policy

To avoid overpaying or being underinsured, follow these tips while selecting a rental car insurance policy:

- Check Your Existing Coverage: Review your personal car insurance, credit card benefits, and even travel insurance to see if they already cover rental cars

- Understand the Types of Coverage Offered: Know what each part of the rental car insurance covers (CDW, liability, personal effects, etc.) and decide which ones you need

- Compare Prices: Rental companies often charge a premium for daily insurance. Compare with third-party insurers or standalone rental car insurance providers for better rates

- Ask Questions at the Rental Desk: Clarify what’s included, what your responsibilities are, and whether the coverage includes towing, roadside assistance, or damage to third-party property

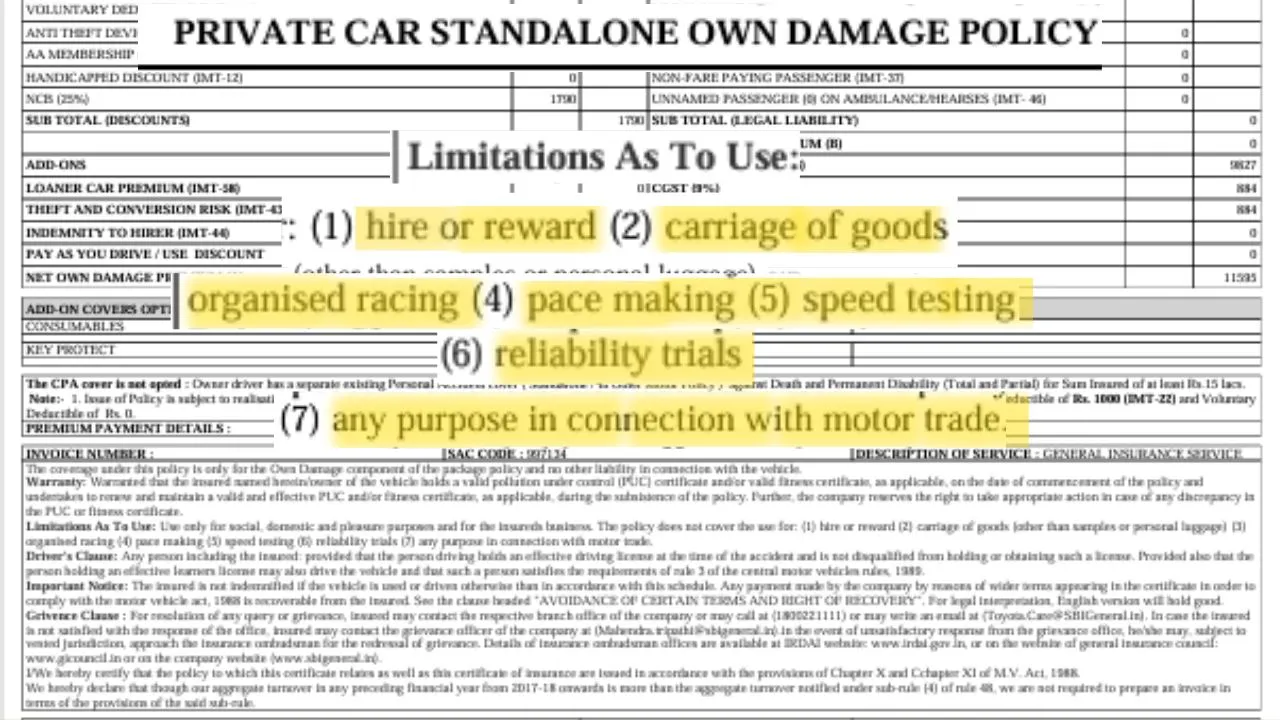

- Look for Exclusions: Certain types of driving (e.g., off-road, reckless behavior) or locations may not be covered. Always read the fine print.

Common Misconceptions About Rental and Standard Car Insurance

Understanding car insurance can be tricky, and several myths add to the confusion. Let’s debunk a few

- My credit card covers everything?

Not all credit cards offer rental car coverage, and those that do may have strict conditions—such as declining the rental company's insurance or using the card to pay for the full rental

- I don’t need rental insurance if I have personal auto insurance?

Your policy may not cover all aspects or may not apply in another country

- Rental insurance is too expensive?

While it adds to the daily rate, it could save you thousands in the event of an accident, especially when your personal insurance has limitations or high deductibles.

- The rental company will automatically cover damages?

Without specific coverage (CDW/LDW), the rental company will hold you liable for any damage or loss

- I’ll never get into an accident—so I don’t need it?

Accidents can happen to anyone, and even a small scrape or parking lot ding can become a costly issue when driving a rental

Before renting a car, take the time to understand the difference between rental car insurance and standard car insurance. While your personal policy might offer some protection, rental car insurance provides more focused, flexible, and often geographically wider coverage. Evaluate your needs based on the trip type, destination, and existing coverage. Being informed can help you make the right choice—avoiding unnecessary costs and ensuring a worry-free driving experience wherever you go

That way, you’ll know exactly what is and isn’t covered—and can walk up to the rental counter with confidence. Need help comparing rental car insurance options or want to find the best car rental for your journey? Feel free to reach out to steer you in the right direction.

All cars are well maintained and company service

All are company owned cars

+91-8113815604

Useful Links

Newsletter

© Binscars. All Rights Reserved.